federal estate tax exemption 2022

The maximum Federal tax rate is 40. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

Did You Know That An Abc Trust A Form Of An Irrevocable Trust Can Be Helpful In States Where The Estate Tax Estate Tax Mirrored Sunglasses Men Tax Exemption

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

. 1 You can give up to those amounts over. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. If the date of death value of the decedents US-situated assets together with the gift tax specific exemption and the amount of the adjusted taxable gifts exceeds the filing.

The Estate Tax is a tax on your right to transfer property at your death. Please visit the Estate and Gift taxes page for more information regarding federal estate and gift tax. The 2022 exemption is the largest in history but it wont last.

Each year the IRS updates the existing tax code numbers for items that are indexed for inflation. Internal Revenue Code and the generation-skipping transfer GST exemption under. This increase means that a married.

Hawaii and Washington have the highest estate tax top rates in the nation at 20 percent. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base. The IRS Announces New Tax Numbers for 2022.

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. Estate Tax Exemption goes up for 2022. What is the transfer tax exemption for 2022.

Positive news exists for beneficiaries who may inherit a substantial estate. Eight states and the District of Columbia are next with a top rate of 16 percent. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021.

A deceased person owes federal estate taxes on a taxable. Commencing January 1 2022 the New York State Estate Tax Exemption amount is 611000000 per person. A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000.

For 2022 the federal estate tax limit increases to 1206 million for an individual and 2412 million for a couple. An estate tax exemption is the monetary value of a persons estate that is not subject to taxation by the federal government. The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. In 2022 the amount of estate tax exemption is. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts.

For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. Their federal estate tax exemption is. This includes the tax rate.

Tax and Estates Alert. Estate Tax Exemption goes up for 2022. Of course the law could remain unchanged leaving the current law in place.

The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million. The new 2022 Estate Tax Rate will be effective.

U S Estate Tax For Canadians Manulife Investment Management

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

Tax Brackets Canada 2022 Filing Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Are Marriage Penalties And Bonuses Tax Policy Center

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Taxtips Ca Ontario 2019 2020 Income Tax Rates

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

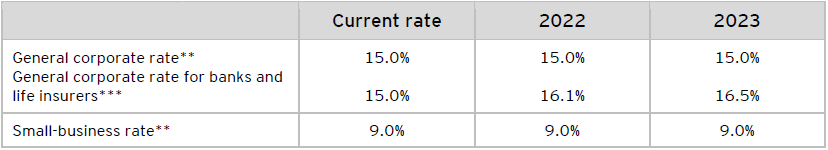

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

10 Ways To Be Tax Exempt Howstuffworks

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

How Do Taxes Affect Income Inequality Tax Policy Center

How To Fill Out I R S Form 1099 A To Discharge Debt In 2022 Form Templates Document Sharing

State Corporate Income Tax Rates And Brackets Tax Foundation